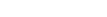

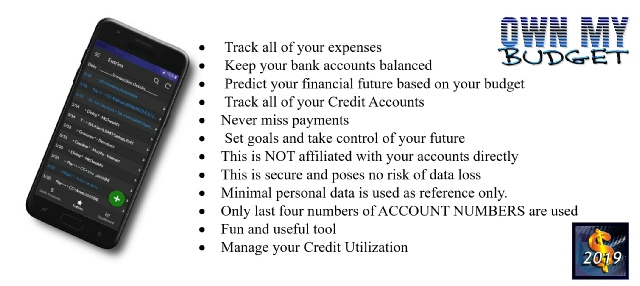

Spend less than 5 minutes a day to check your entries and see what is planned for the day. You will know what expenses are coming due. Daily you can check with your bank and balance your accounts. Entries that are highlighted have not been posted. For each entry you will see what was budgeted, you will need to enter the actual amount. The app will make balancing with your accounts easy. You will not have to waste time balancing with your bank statements ever again. You will be balanced daily. It is important for each transaction that you make that is not budgeted is entered. Most of your expenses will be automated. The whole purpose of the design is to allow you to keep track anytime, anywhere, anyplace. Not too many people sit in front of their computer these days. The convenience of mobile applications makes tasks like your budget a breeze.

No more need to be worried if you will have sufficient funds to cover everyday expenses. The ability to see months down the road will allow you to be able to start saving money. You will also be able to have money when the unthinkable happens and there is a major unexpected expense.

I have been designing this for years with the use of a spreadsheet that I manually entered the data and started with simple formula’s to start keeping track of things. I soon saw the power of the design and have used it in spreadsheet form for 5 years now. The idea worked so well that I developed this app to help others in the same manner that it has helped me. I have started over financially a couple times after life throws you a curve ball that you cannot dodge. I have had the worst of credit. I had bounced checks and let banks walk all over me with their fees.

The last time I started over I decided that I needed to take control. That is where this idea began. This app is for everyone. Those that need direction to regain their financial control, as well as those that have their finances handled, but want any easy solution to make things even more effective without the hard work.

Here is how simple this is.

Here is how this works.

- Step 1 Get the app from Google play

- Step 2 Complete each step thoughtfully and accurately. Gather your bills, bank statements, credit account statements and what other information that will allow you to be honest with yourself for this to be most effective. Keep in mind that the ideal time to start this app will be at the end of the year for the next year. But, don’t let that stop you. You will become familiar with the app and its abilities.

- Step 3 Start with the App SET UP Complete all of the questions accurately. This will ask you how often you get paid and what is the average amount. If you get bonuses, that will be added later. This is just guaranteed income that you can always depend on. It will ask you simple questions about your Misc. Expenses. How often do you eat out. Do you go to the movies, etc. This is building a foundation so that you can easily see the overall picture and make adjustments accordingly. After you complete this section, indicate that you are completed when asked.

- Step 4 Complete your Bank Accounts. There are a maximum of 5 allowed. I know what you are thinking, 5 banks? Yikes, that is a lot….. but most families or individuals for that matter have a Primary Account, Savings Account, possibly savings accounts for kids, money markets, etc. you get the idea…… If for some reason, you need more accounts, you will have to contact us for special coding to accommodate you.

- Step 5 Complete your Monthly Expenses . There are several that are predetermined to get you started. They can be customized to suite your needs. There is also room to add additional accounts, for a total of 23 Expense Accounts. Make sure you are accurate in when and how much your expenses are. Make sure that if asked, you list the exact date the first payment is required. This is especially important for accounts that are billed quarterly. The first date dictates the remaining dates in the budget.

- Step 6 Complete your Credit Cards if you use them. If not, that is OK also. IMPORTANT … Make sure that you list the beginning account balance correctly for the time frame that you are using this app. If you are starting the app in May, get the balance due from your Credit Card company online or from the previous statement and make sure that it is currently balanced to the amount that you are entering. Also important, Include the correct due date and take 3-

5 days off of that. This way when the bill comes due, if you don’t schedule automatic payments, you will have a few days to pay the bill BEFORE it is due. Ex. Statement shows that your card is due on the 8th of the month. You would put down that it is due on the 3rd, 4th, or 5th. Always give yourself min 24- 48 hours for Credit Companies to post your payment! The maximum allowed is 10 Credit Cards. - Step 7 Complete your Credit Accounts if you use them. If not, that is OK also. Credit Accounts are similar to Credit Cards, except that they are Store Credit Accounts. Ex. Walmart, Best Buy, Home Depot, etc… IMPORTANT … Make sure that you list the beginning account balance correctly for the time frame that you are using this app. If you are starting the app in May, get the balance due from your Credit Account company online or from the previous statement and make sure that it is currently balanced to the amount that you are entering. Also important, Include the correct due date and take 3-

5 days off of that. This way when the bill comes due, if you don’t schedule automatic payments, you will have a few days to pay the bill BEFORE it is due. Ex. Statement shows that your card is due on the 8th of the month. You would put down that it is due on the 3rd, 4th, or 5th. Always give yourself min 24- 48 hours for Credit Companies to post your payment! The maximum allowed is 14 Credit Accounts. - Step 8 Complete any Scheduled Banking. Scheduled banking could be used for bonuses, transfers between bank accounts, and other scheduled deposits. There are two predetermined transactions designated for paychecks. A total of 9 transactions are allowed. If you change jobs or your payday changes, you need to start a new transaction so that the app retains the original information. Keep in mind that this app is designed for budget purposes. Any Scheduled Banking that you list here is independent from your bank. This is for record keeping only. You still need to set up the actual transactions through your bank accordingly. If you need more scheduled transactions, please contact us for customized coding.

DASHBOARD

Your Own My Budget app will always open to a dashboard. It will indicate the status of funds available. It will list your Primary Bank Account balance, what amount has not posted and what your bank is showing for your current balance. Your bank balance should match the Bank Actual amount. Your Primary Bank Balance will always reflect what is available determined by what has posted. For instance your Bank Actual Balance amount is $100.00, you just wrote a check for $20.00 that has not posted. Your Primary Bank Balance is $80.00, and your Not Posted amount should equal $20.00.

You will see Annual Budget. If this is a negative number, you are below budget and going in the right direction. The app will state that you are either over or under budget for the calendar year.

You will also see Weekly Budget. This is the same thing. If this is a negative number, you are under budget, as will the app indicate this.

Your Projected Income is listed. This is simply calculated by using the income that you have listed.

Projected Expenses are determined from all of your Monthly Expenses that are listed as well as calculated Misc. Expenses determined from the Set Up. Note* if you are over budget, you may need to re-

The Annual Net Value is determined by how well your budget is balanced. This should always be a positive number. This indicated that you are under budget. You are spending less that money coming in. This amount reflects how well you are doing.

The Overall Net Value is the overall value of this years budget along with any assets that you carried over from the previous year.The first year, this is calculated from your beginning balances. The amount of money in each of your bank accounts, whether it is a savings account, checking account, or money market account.

Your Credit Card Utilization is calculated from your available credit from both your Credit Cards and your Credit Accounts compared to how much of that credit you have used. This is a simple ratio that your credit score is weighed on along with other factors. It is important to keep this number below 30%. The lower the utilization number is, the more positive the impact will be on your credit score.

Credit Limit is the amount of credit available to you. This is calculated from your Credit Cards and Credit Accounts. If your credit limit is increased/decreased from one of your credit cards/accounts, you need to adjust that account as time passes so that this remains accurate. Ex. My VISA bank increased my credit limit from $3,000.00 to $5,000.00. You would find your VISA account in Credit Cards from the menu and adjust the Credit Limit for that account.

WEEKLY PICTURE

The CURRENT WEEK is highlighted in YELLOW.

Your Weekly Picture provides details for each week, past, present, and future. This shows you how much money is available weekly. If this is a negative number, you need to find out where you are spending more that you are making. This should not occur if your budget balances. However, if it does, look at your expenses. Maybe there are too many bills coming due in a certain time of the month. If this is the case, contact customer service for that account and ask that a due date be moved. Sometimes this is possible and can be most helpful. Not all companies offer that, but it is worth a try!

This will list Bank Deposits made for each week in the past and anticipated deposits in the future.

Actual Spent is the amount of money you spend each week, and will be shown for past weeks.

Unpaid Expenses are expenses that are budgeted for the CURRENT WEEK, that are still due.

Budgeted Misc. Are expenses that you calculated in the Set Up from the questions that you answered. If you take the total Misc. Expenses that are NOT Monthly Expenses and divide that total over the entire budget year, this amount each week is what is anticipated. Some weeks more money will be spent, others, just the opposite. Let’s say that you take one vacation over the year, and that you stated that you spend $500.00 for that vacation. Divide that over 52 weeks and the weekly cost is now $9.62. Lets say that you started this app in the middle of the year, perhaps on the 15th week. The amount that you put, still being the $500.00 for vacation would be divided over the remaining weeks of the year. 52 weeks minus 15 weeks = 37 weeks. Divide $500/37 and the amount is now $13.51 per week for vacation.

Misc. Expenses Spent is the actual amount that you spent id past weeks.

Credit Charges displays the amount of Credit that you charged each week.

Budgeted Credit Payments lists payments that you have made in the past along with estimated payments by week in the future. This is calculated from the amount that you owe for each account, includes your monthly minimum payment that you included when you set up the Credit Card or Credit Account, and includes a formula to include any interest owed that would be due. This formula that I have created will increase your monthly payment to pay the card down faster that what the credit company requires and allows you to budget for that. If you normally pay your cards off immediately, this will not apply to you, but it is there if needed.

Credit Payments lists what you paid in the past towards your Credit Card/ Credit Account Debts.

Credit Utilization is listed for each week, so that you can set goals and see trends. The lower the number, especially lower than 30% is most ideal.

So, get started today. This is not only fun, but this is rewarding.

Take charge of your future. You too can say …. I now OWN MY BUDGET instead of …………… your debt owning you.

This budget needs to be used daily to be effective. Think of your entries like a check register for EVERYTHING. Every transaction that you make needs to be updated and entered. Most of the work will be done for you. Most of your expenses will populate daily, you just need to put in how much you actually spent. I literally use this app for 3-

ONE BIG HAPPY CHECK REGISTER FOR EVERYTHING!!!!!!

It is with you where ever you go. Any time, any place is convenient.

Your credit score will go up.

You will have less stress remembering what and when bills are due.

How well you enter the initial information into that app will determine your success.